Estate Planning for Nontraditional Families

Published: June 30, 2022

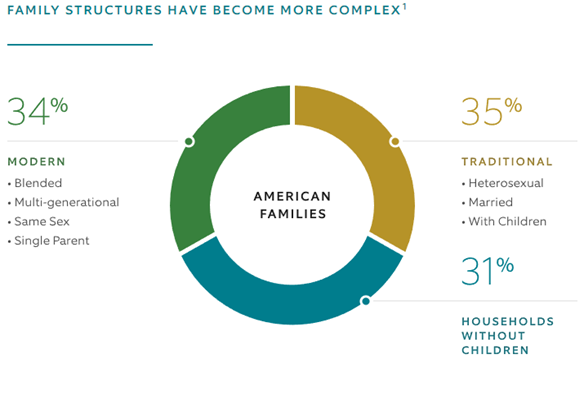

The practice of estate planning is evolving due to changing family structures. As recently as thirty years ago, a traditional family comprised a husband and wife who married young, purchased a home, had children, and worked toward financial stability and security. In 1949, 79.8 percent of American households were married couples, but in 2021 that number declined to 47.3 percent.

The rise of blended families, cohabitating couples, artificial reproductive technology, same-sex marriages, and other trends mean only one-third of American households are “traditional” families. The other two-thirds are non-traditional families experiencing unique needs that challenge current estate planning models.

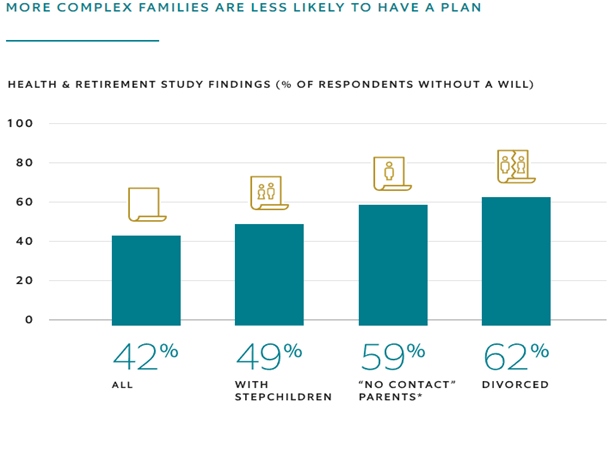

More complex family structures tend to avoid estate planning. But the absence of planning leads to an increase of needlessly squandered assets lost to estate taxes and family infighting over an inheritance. Dying without a will (intestate) means your estate will go through probate and follow the state’s intestacy laws that currently don’t favor unmarried partners and step-children. Fortunately, proactive planning with an estate attorney to build a modern plan can provide the best outcomes for the legacy and security of your non-traditional family.

Blended Families

In particular, if you divorce, remarry, have additional children and grandchildren, or experience other significant changes in your family dynamics, do not delay creating or updating your estate plan. While the decision-making about specific assets, beneficiaries, and transferring wealth during family changes may sound overwhelming, your estate planning attorney is there to guide and support you. Updating your plan can avoid unintended consequences such as strained relationships, wasted financial resources, and more.

Conventional estate planning tends to favor traditional family structures and equal wealth bequests; however, this may not be your intention in a blended family with step-children. Creative solutions that reflect your contemporary family structure can successfully address these issues. Customizing your plan to meet unique needs makes more sense.

Pre- and Post-nuptual Agreements

Clarify your needs using pre and post-nuptial agreements if you intend to remarry. A new spouse needs to be aware of how you intend to distribute your assets to your children, mutual children, spouse’s children, and any other beneficiary. Early on, agreement on critical decisions about estate and gift tax exemptions can prevent future problems. A family law attorney can work with your estate planning attorney to ensure that the agreement structure complements your intentions regarding your estate.

Trusts and Other Strategies

In a blended family, you may consider alternative strategies to transfer wealth. If you choose to remarry, you may promote better family relationships with lifetime gifts to your children rather than after-death bequests. You can also use payable on death accounts which transfer directly to the beneficiary outside of your will and any trusts if necessary.

In the case of trusts, expand and clarify estate planning provisions and potential issues that may easily be overlooked, like:

- Scenarios where your children enter into a committed relationship without marriage and have children

- Representatives or trustees who may not share or understand your goals for future beneficiaries. For example, if you create a trust for grandchildren, will you include future step-grandchildren or those born from artificial reproductive technology? Will a biological trustee follow through with your wishes for non-biological children, or do you need a neutral third party?

- Cultural and religious traditions that don’t align with your estate planning documents related to inheritance and end-of-life wishes. Do your trust provisions, investments, and discretionary distributions reflect your values? If you are against fossil fuels, will you limit trust equities to permit only green energy investments? Do you have specific political views or particular people you do not want receiving any of your assets second hand? Does your end-of-life plan reflect your spiritual beliefs?

If your family system is non-traditional, be aware that most US laws and estate planning practices tend to favor a traditional family structure which can leave some of your loved ones overlooked without careful planning. Knowing about these default favoritisms and standards should help you think carefully about specific provisions for your non-traditional family. Open discussions with your family and estate planning attorney will help you craft a better and more representative plan suited to your family. We hope you found this article helpful. If you have questions or would like to discuss your legal matters, please do not hesitate to contact our office at 215-364-1111 to schedule a consultation.

Call Today: 215-364-1111

Call Today: 215-364-1111